Silver has always been woven into Indian life from heirloom bangles and everyday silver utensils to festival coins and the small tin box that quietly safeguards memories and emergency cash. It has long been a trusted choice for gifting too, whether welcoming a newborn into the family or blessing a newly married couple. Yet over the last decade, this once-understated white metal has moved beyond tradition and sentiment, emerging as a credible store of value and a practical financial instrument.

This post takes you through the journey of silver prices in India over the past ten years, highlights recent government and regulatory changes that have made silver more viable as collateral, and explains why Gahane Jewellery with its hallmarked silver, transparent buy-back policy, and legacy of fine craftsmanship deserves consideration not just as jewellery, but also as a thoughtful safety investment.

1) How silver prices changed then vs now (Indian market)

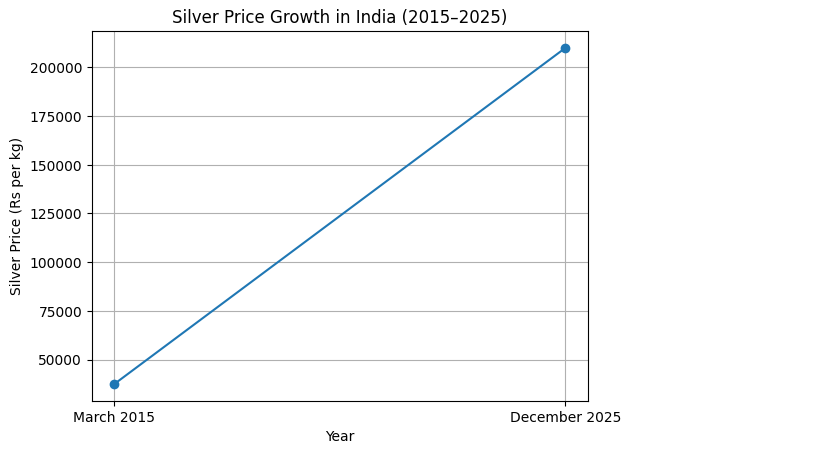

· In March 2015, silver prices in India were trading in the range of Rs 37,000–Rs 38,000 per kilogram, reflecting a phase when silver was largely viewed as an affordable precious metal rather than a high-growth investment. Market retrospectives and long-term price analyses published by The Economic Times highlight how silver prices remained relatively subdued during that period due to stable global demand and limited industrial consumption.

· By December 2025, silver prices in Indian retail markets have surged dramatically to nearly Rs 2.1 lakh per kilogram, touching multi-year highs across major cities. This sharp rally has been widely reported and analysed by The Economic Times, attributing the rise to strong industrial demand, global economic uncertainty, inflationary pressures, and renewed investor interest in precious metals as alternative assets.

· Overall, this marks an increase of approximately 450–460% over a decade, a remarkable appreciation that underscores silver’s transformation in the Indian market. As noted in multiple Economic Times market explainers, this sustained price momentum is prompting Indian households and investors to reassess silver not merely as jewellery, but as a credible store of value and long term investment asset.

2) New borrowing power government / regulator changes

A significant regulatory shift is redefining silver’s financial role in India:

- The Reserve Bank of India (RBI) has issued updated lending guidelines permitting banks, NBFCs, and cooperative banks to accept silver jewellery and silver coins as collateral, effective 1 April 2026. This policy development has been reported and analysed in detail by The Economic Times.

Key features you should know:

- Standardised valuation norms: Lenders will assess silver collateral using benchmark prices derived from recognised exchanges such as MCX or IBJA, based on either the 30 day average price or the previous day’s closing price whichever is lower. This framework has been explained across financial dailies including The Economic Times and industry briefings.

- Loan to Value (LTV) limits: Similar to gold loans, smaller ticket silver loans may allow LTV ratios up to ~85%, with progressively lower limits for higher loan amounts. Caps on pledge able silver quantities per borrower aim to curb speculative lending again highlighted in The Economic Times’ policy analysis.

What this means for you

Silver that once remained purely sentimental stored in lockers and cupboards can now serve as a regulated, formal source of credit, reducing the need for distress sales during financial emergencies. This shift strengthens silver’s position as a liquidity backed safety asset for Indian families.

3) Why Indian buyers should look at silver today

- Strong price appreciation: A decade of consistent gains has positioned silver as one of the most eye-catching performers among precious metals, especially for long-term holders.

- Industrial demand & macroeconomic drivers

As explained by Investopedia, silver plays a unique dual role as both a precious metal and an industrial raw material. Its extensive use in electronics, solar panels, medical equipment, and emerging green technologies makes silver highly responsive to global manufacturing trends, currency fluctuations, and interest-rate cycles. Unlike gold, this dual dependency results in higher price volatility introducing greater risk, but also offering stronger upside potential during periods of economic expansion. Indian market movements tracked through MCX further reflect how global macroeconomic shifts directly influence silver prices.

Financial inclusion advantage: RBI’s inclusion of silver under formal lending norms allows households and small businesses to unlock credit without selling heirloom jewellery, a practical benefit highlighted in mainstream Indian financial commentary

4) Now focus on the brand: GahaneJewellery

You asked to spotlight Gahane Jewellery and how their silver fits the investment/security story. Here’s how Gahane positions itself and why that matters for buyers:

Hallmark & purity

Gahane emphasises that its silver pieces are hallmarked and stamped with purity assurances a crucial point if you want jewellery that is acceptable as collateral and trusted for resale. When a piece carries a recognised hallmark, banks and buyers can verify weight and purity more easily.

Buy back / exchange policy

Gahane publishes an exchange / buy back policy: they offer an exchange/ buy-back (around 80% if exchanged undamaged) under stated conditions a customer-facing guarantee that adds liquidity and resale confidence.

Craftsmanship & resale channels

Gahane markets handcrafted silver pieces with traditional motifs, and the brand sells via its website and selected retail channels. Hallmarked, well documented silver from an established maker typically fetches better resale value than unbranded or uncertified items. For clarity on authorised resellers or institutional partnerships, check Gahane’s official channels or contact them directly.

5) Is Gahane silver a “safety investment”?

Short answer: Yes with caveats.

Why yes:

- Hallmarking + brand buy back reduces the friction of converting jewellery to cash

- With RBI’s new framework, hallmarked jewellery becomes more bankable as collateral a concrete safety benefit.

Caveats:

- Silver is more price volatile than gold. If you need a guaranteed steady store of value over a few months, volatility matters.The Economic Times

- Brand buy back rates and resale depend on condition, current spot price and the brand’s policy at the time of sale. Always keep paperwork, original invoices and hallmark certificates safe.

6) Resale value & secondary market behaviour

- Resale value depends on: purity (hallmark), weight, workmanship, whether the piece has gemstones or extra alloys (gemstones’ value may be assessed separately), and the current silver market price.

- Branded vs unbranded: branded, hallmarked pieces from known artisans like Gahane generally trade with less friction and often better realized prices than uncertified pieces because buyers and banks can trust the metal content.

7) Tips for buying silver jewellery as an investment

- Insist on hallmarking and a written purity certificate. Hallmark = acceptability for loans/resale.

- Keep invoices & hallmark cards safe banks and resale houses will ask for them.

- Prefer plain weighty pieces for loan/ resale valueornate pieces with heavy gemstones may have different valuation rules.

- Check brand buy back policy in writing (percentage, time window, condition requirements). Gahane’s stated policy gives buyers a predictable exit route.

- Think long term silver can rally big but also swings use it alongside safer instruments and emergency funds.

8) Final thoughts emotional and practical

Silver carries memory: the bangle your grandmother wore, the first coin you were gifted as a child. Now it also carries liquidity and regulatory recognition. For Indian buyers who want to blend culture with financial sense, hallmarked pieces from a credible brand like Gahane offer a pragmatic bridge jewellery you can wear, inherit, and if needed, convert into credit or cash with less friction.